What does Christax do? What services do you provide?

Christax provides tax preparation

and accounting services for individuals and small-business

owners in Cooper City. We are open from 9 a.m. to 7 p.m. All you have to do is get us your tax information and we'll prepare, calculate and submit your return on your behalf. The services we provide include: Income tax preparation, business tax services, corporate financial consulting and more.

What do I get when I come to Christax to file?

With Christax, you get a committed professional to review, prepare and file your return. We can also review previous returns, give advice as to how to reduce tax burdens on future returns and assist you in the event of an IRS audit. For small-business owners, we can assess your books, prepare a schedule C and prepare your personal tax return. Our services are tailored to you, so you never get more or less than you need.

Can Christax help me prepare for future tax returns?

American tax laws can be complex and confusing. That's why we offer our

tax preparation

services year round. During tax season, we can help you prepare and file your taxes, and during the off-season, we can assist you to ensure that you'll be ready when the season starts back up. We'll work with you to plan a strategy that will leave the most amount of money possible in your pockets.

I've been contacted by the IRS. Can Christax help?

If you've found yourself in trouble with taxes or the IRS, Christax can help! We can offer advice and assistance to ease your dealings with the IRS, and after the issues are resolved, we can set you up on a path that will help avoid any future issues.

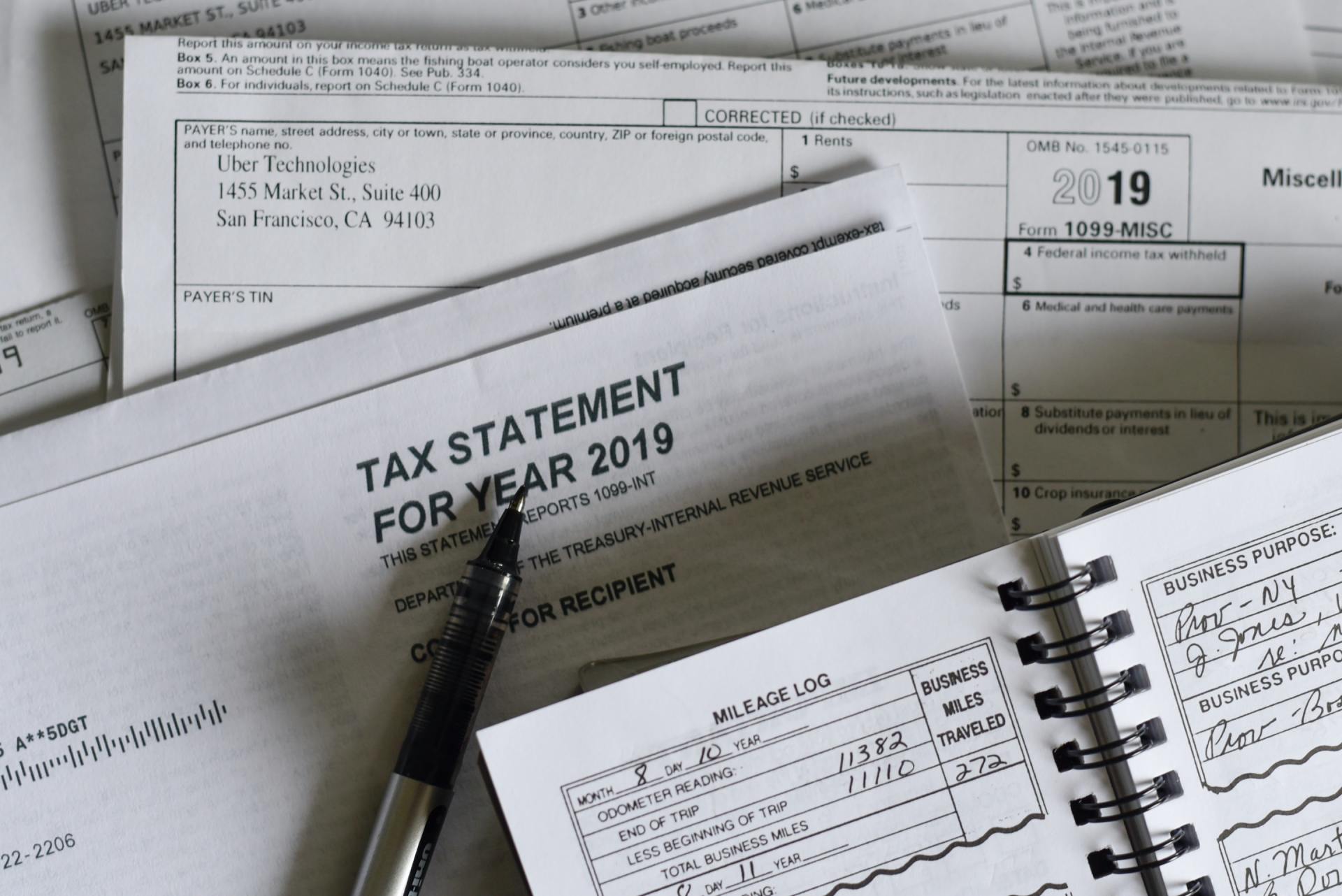

What do I need to bring to an appointment at Christax?

For tax preparation services, most people will need to bring their W-2. Independent contractors will need to bring a 1099-Misc. You will also need to bring records of your relationships and assets. Are you married? Do you have any dependents? Do you own property? Have you made any charitable contributions? Have you invested in anything or sold any stocks or cryptocurrency? All of these things could affect your refund, so make note of them ahead of your appointment.

The documents you need to bring to complete your income tax include personal information including a photo ID, your social security number (preferably your social security card), your spouse's full name, and social security number (if you are finding a joint return). If you have children you may want to bring child care records. If you are divorced you may want to bring your divorce decree. If you have a question about what documents are required to complete your tax return, contact a Christax

tax preparation

consultant.

For small-business owners, as long as you have some sort of record-keeping system, we can help sort everything out. If you have further questions regarding record keeping, reach out to us through phone or through one of our contact boxes and we will contact you as soon as possible.

Do I have to file taxes?

If your income is above a certain amount, you must file federal and state income tax returns. The amount depends on your filing status, age, and the type of income your receive. Even if you are not required to file taxes, you may want to file anyway to get back federal and state taxes that might have been withheld from your pay. If you are unsure of whether you are required to file taxes, contact us today and a Christax tax consultant will help you determine what course of action to take.

I made a mistake on my taxes, what do I do?

This depends on what kind of mistake you made. If it is a mathematical error, it will most likely be caught while the tax return is being processed, and the IRS will then correct it. If you made a mistake on your filing status or you need to change your income, deductions or credits, then you will need to file an amended tax or corrected return using Form 1040-X. You have 3 years from the time you filed the original return or 2 years from the day you paid the tax. To avoid making mistakes, fill out your return with the help of the

tax preparation

professionals at Christax.

I have made charitable contributions. Can I claim them without a receipt?

Yes, you can still claim your charitable donations, even without the receipt. Make sure that you have records of them in the event you are audited. Make sure to record the name of the organization, the date and location of any contribution, as well as a detailed description of what you donated. Keep tracks of the market value of any items donated. When it comes to monetary donations under $250, a canceled check or payroll deduction can suffice for proof of the donation. If you have questions about tax preparation, contact us today.

Why Christax?

Good question! There are a multitude of options for taxpayers to choose from when they go to file. What makes Christax more valuable than the rest? First and foremost, Christax cares about its customers. Being a local, independently owned tax preparation service in Sunrise, Christax knows the area and the value of the community. National chains run their customers through the same standardized process to try and squeeze the most money out of you with the lowest amount of effort from them. At Christax, we know and value our customers, and we always offer personalized support tailored to each individual who comes to us for help. We're not going to nickle and dime you, or try to lock you into paying a significant sum from your refund. We'll give you exactly what you need, when you need it. No more and no less. After all, you worked hard for your money, and we're here to help you keep it.